Clear math...

Following up on yesterday’s post, I’ve got more to say about the just-approved tax cut, which is really a decrease in the maximum allowable annual increase in your taxes, but for the sake of argument (and to please the Republicans) we’ll call them tax cuts.

The short story is: The council approved a measure that would lower the annual assessment increase from 5 percent to 4 percent. The county executive, meanwhile, has proposed lowering the tax rate by $0.03 per $100 of assessed value; because he is more in favor of the tax cuts that were his idea, naturally, Robey has threatened to veto the council bill, which was approved with votes from the two Republicans and David Rakes.

Now, with that out of the way, Howard County Blog #1 writes:

Don't let the effective dates and first year savings on these competing tax cuts fool you. Feaga calls it a very small decrease.Interesting, no? First, the difference between revenue “cuts” and “limits” is semantic. Second, what about the math? Will taxpayers have a significantly lessened burden under Feaga’s plan?

In the first year it is... Run the math on a $400,000 home and use the current property tax rates. The savings snowball over time. That 1% decrease in the cap is not insignificant - it is huge. I like that. It doesn't cut County revenue it limits the revenue.

Compared to Robey's tax rate cut proposal, which I like too, Feaga saves tax payers a lot more money over three years than Robey's plan. Take the math out 7 years and the savings are twice what Robey's plan proposes.

No.

Before we can go to the numbers, we’ve got to understand the assumptions. Obviously, we’re talking about a $400,000 house. Also, in order to project out seven years we have to assume that everything stays the same - well, mainly that tax rates don’t change, which I would say is pretty unlikely, and that the owner remains in place the whole time. But for the sake of this exercise, we’ll make those assumptions.

There is one more assumption, but we’ll get to that in a minute. First, the numbers.

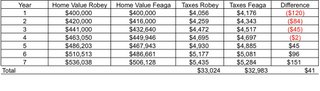

(The picture is clearer if you click on it.)

Interesting, no?

So, what does this chart mean? Under the “Home Value Robey” column is the value of our fictional home assuming Robey vetoes Feaga’s bill and implements his tax plan. The assessed value of the home goes up 5 percent a year and the tax rate is $1.014 per $100. On the other hand, the “Feaga” columns represent what happens if his proposal is passed and Robey’s is not; that is, the assessed value of the house increases at 4 percent a year and the tax rate is the same as it is now, $1.044 per $100 of assessed value.

As you can see in the “Taxes” columns, Robey’s plan saves homeowners more during the first four years, and it’s not until year five that Feaga’s plan takes over. However, by the end of seven years, it’s basically a wash -- $41 difference in taxes between the two plans.

But what about that last assumption? Well, in order for Feaga’s tax cut to actually amount to it’s $41 over seven years savings, property values in Howard County have to continue to grow at least 4 percent a year for the next seven years. This is entirely possible, but it’s also entirely possible that it won’t happen. Check out this website to get an estimate of your home’s worth, and then look at the graph of that value over the last 5 years. Twenty, 30, and 40 percent increases in property values are not sustainable - no matter what your real estate agent tells you. I don’t think we’re in for a busted bubble in Howard County, but I also don’t think we’ll be talking about sustained double digit growth either. As the graphs in the above website show, we are already seeing “leveling out” of home prices.

Feaga’s proposal is great when we’re in a time of rapidly rising property values. In other words, his proposal would have been great five years ago.

Given the immediacy of the tax bills - and the deferred savings from Feaga’s plan - Robey’s proposal is clearly the better option, at least if we’re concerned about cutting taxpayers a break when they need it most (Now!). The massive increases have been realized, and implementing a tax policy that is meant to stem additional growth in our tax burden would be not only late, but ineffective as well.

2 comments:

Nice post. It is good to have someone looking over one's shoulder. I should not have assumed that the reader would take it upon themself to dive into the numbers and the issue more thoroughly. Obviously you didn't so I posted more details at:

http://hocomd.blogspot.com/2006/03/feagas-assessment-cap-revisited.html

I've put up my response to both you and HoCoBlog here

Post a Comment